Anil Ambani’s life is a roller coaster ride. Anil Ambani was on the Richest Person list, to a Bankrupt Businessman. Recently, Anil Ambani’s Companies, Reliance Power and Reliance Infra, have turned positive.

Reliance Infra and Reliance Power stocks gave huge returns because both companies started making profits, as well as companies won back-to-back huge contracts.

Reliance Power and Reliance Infra Stock Surged

Reliance Infra Stock has gained almost 95% in the last 1 Year and 1070% in the last 5 years. Reliance Power stock has also gained almost 125% in the last 1 Year and 1775% in the last 5 years.

Reliance Infra Bet Huge on Defence Sector

Reliance Defence announced a strategic deal with Coastal Mechanics Inc. for a 20,000 crore defence maintenance, repair, overhaul, and upgrade market opportunity.

Reliance Defence and Coastal Mechanics will target a wide range of critical platforms, including over 100 Jaguar fighter aircraft, over 100 MiG-29 fighter aircraft, the Apache attack helicopter fleet, L-70 air defence guns, and other legacy systems.

Reliance Infra subsidiary company Reliance Defence is investing huge in the Aerospace sector with a 10,000 Crores investment. Reliance Defence partners with Dassault Aviation for developing India’s first homegrown commercial aircraft.

Reliance Power Won Major Orders

Reliance Power subsidiary, Reliance NU Energies Private Limited, received the Letter of Award (LOA) from SJVN Limited for a 350 MW inter-state transmission system (ISTS)-connected solar power project coupled with a 175 MW/700 MWh Battery Energy Storage System (BESS).

Reliance Power also signed a 25-year Power Purchase Agreement (PPA) with the Solar Energy Corporation of India (SECI) to supply solar power backed by battery storage.

Reliance Power also signed a major deal with Bhutan. Reliance Power has entered into a 50:50 joint venture with the Bhutan Government’s Druk Holding & Investments. This Joint venture is to develop a 500 MW solar project and a 770 MW hydropower project in Bhutan.

Reliance Infra and Reliance Power Turn Profitable

Reliance Infra Reduced debt significantly. The Company is focusing debt-free next year. Reliance Infra reported a net profit of 4,387.08 crore in Q4 FY25. This is Huge because last year in the same quarter company reported a loss of 220.58 crores.

Reliance Power also shows huge improvement in Q4. Reliance Power reported a consolidated net profit of 126 crore for Q4 FY25, which is way higher than the net loss of 397.56 crore in Q4 FY24.

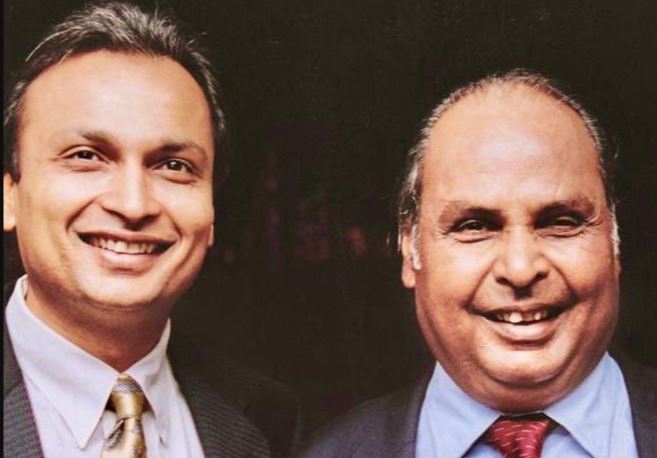

Anil Ambani’s Early Life

The Reliance Empire is being split after Dhirubhai’s death. Elder brother Mukesh Ambani got the Reliance Industries oil, petrochemicals, and refining business. On the other hand, Anil Ambani got RCom, Reliance Power, Reliance Infrastructure, and Reliance Capital. Those businesses were so powerful during those times.

Anil Ambani’s company had huge potential, and Anil Ambani became one of India’s richest men. In 2008, Anil Ambani’s net worth touched $42 billion.

Good Days of Anil Ambani

Rcom was the 2nd Largest telecom company in India. Anil Ambani expands aggressively. Anil Ambani even bid for 3G spectrum licenses and took on massive debt. Anil Ambani even raised huge money through through Reliance Power IPO. In 2008, Reliance Power came up with India’s biggest IPO at that time (raising $3 billion). Even Reliance Infra Won major road, railway, and metro projects.

Bad Days of Anil Ambani

The 2008 Financial Crisis was the major reason for Anil Ambani’s downfall. Anil Ambani took on massive debt for his company’s expansion plans. Anil Ambani’s projects required massive money, but banks became cautious after the crisis. Many Reliance Power projects are delayed due to land and fuel issues.

Anil Ambani’s RCom took massive loans for expansion but couldn’t repay them. In 2016, Mukesh Ambani came with Reliance Jio and disrupted the telecom market with free 4G services. Many Telecom players couldn’t survive. In 2019, RCom declared insolvency, with debts of ₹45,000 crore.

In 2020, Anil Ambani declared bankruptcy in India. Anil Ambani even said in the UK Court that his net worth had gone down to zero. He even sold all his jewelry to pay legal fees.

Now, Good Days are coming back

Recently, Anil Ambani made a huge comeback through Reliance Power and Reliance Infra.